MUMBAI: In a relief to customers,

RBI

on Monday

relaxed

the

deadline

on most of the

restrictions

imposed on

Paytm

Payments Bank to March 15 from Feb 29, including accepting fresh deposits. It also clarified that QR codes and soundboxes that are not linked to PPBL will continue to work after mid-March.

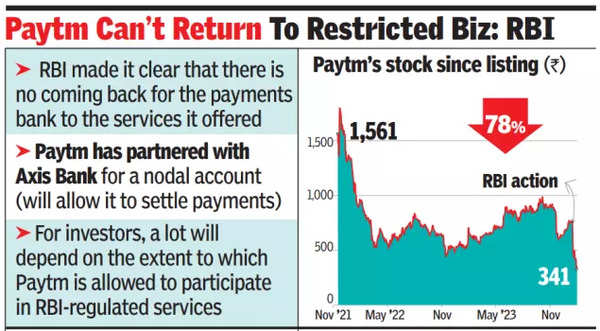

However, RBI made it clear that there is no coming back for the payments bank to these services.

RBI unambiguously advised customers to apply for new Fastags and National Common Mobility Card (NCMC) cards used in metros and buses if they are currently Paytm customers. It also said that those who are using PPBL savings accounts to receive subsidies, salaries or government benefits should open new bank accounts.

Paytm shares, which have been hammered for weeks after RBI action, were up 5% as the market looked for life beyond PPBL for the parent company. While RBI appears to have taken a tough stance on PPBL and ensured that there is no disruption in the UPI payment space, there will be challenges going ahead. PPBL has issued close to 45 lakh Fastags which will have to be replaced by other banks. The tough KYC norms require that customers cannot own two Fastags accounts at the same time. PPBL is also the banker for 253 toll plazas for electronic collection and a new bank will have to step into its shoes.

For millions of shopkeepers and handcart vendors (3.5 crore, according to RBI data) who display the Paytm QR code there will not be much disruption. Sources said that the number of merchants that had linked their QR codes to Paytm Payments Bank was only in lakhs as most preferred their physical banks with ATMs to the bank.

According to sources, Paytm has partnered with Axis Bank for its nodal account. Nodal accounts are those where funds are held in escrow pending settlement and a source of float money to the bank. Even though PPBL does not get fresh money from depositors, the nodal account will continue to receive settlement funds from the merchant acquiring business.

Although RBI’s FAQs did not expressly mention that the Paytm virtual payment address (VPA), which is used by crores of app users, will be functional, the RBI deputy governor had on February 8 said that the UPI app linked to other handles will continue to work. According to bankers, the fact that merchant QR codes will work after March 15 was an indication that the @paytm handle will remain operative.